Australian Capital Territory

All forms of gambling in the Australian Capital Territory, including casinos, are regulated by the ACT Gambling and Racing Commission. This independent authority was established under section 5 of the Gambling and Racing Control Act 1999. The Canberra-based Commission administers the territory’s gambling laws and regulates the activities of casinos as well as all other betting and gambling establishments.

The Gambling and Racing Control Act 1999 is the principal gambling legislation in the territory, although it has been amended several times over the years. Its latest version came into effect on December 1, 2019. All rules and regulations regarding casinos, including licensing and taxation, are set out in the Casino Control Act 2006 and the Casino Control Regulation 2006 enacted under that Act. According to the latest republication of the Casino Control Act 2006, effective from October 2, 2018:

“(1) Only 1 casino licence may be in force under this Act at any particular time. (2) The casino licence is to apply to 1 casino only.”

The casino operating license is granted by the ACT Government, represented by the Commission and the Attorney-General, who heads the Justice and Community Safety Directorate. Pursuant to Section 41 of the Casino Control Act 2006, individuals must also hold licenses to work in key areas of the casino, such as gaming, security, or finance. This rule does not apply to those employed in low-risk areas, including food and beverage services or cleaning. Short-term Casino Employee Licenses are issued for up to 6 months, while full licenses are valid for 3 years.

Casinos must monitor all gaming activities on their premises through continuously recorded closed-circuit television. Children and young persons under 18 years of age are not permitted in casinos. Establishments are required to operate during the core trading hours, defined as “between midnight and 2 am and between 5 pm and midnight on any day,” yet they may open at any time of the day or night.

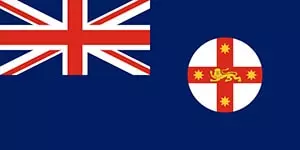

New South Wales

Casino gambling in the state is controlled and regulated by Liquor & Gaming NSW. The agency was established in 2016 in Sydney as part of the Department of Customer Service. It is responsible for implementing all laws and regulations governing the sale of liquor, licensed clubs, gaming activities, and casino operations.

Many of its functions and duties, however, fall within the scope of the Independent Liquor & Gaming Authority (ILGA), a body established under Liquor & Gaming NSW. ILGA sets licensing rules and oversees a wide range of regulatory and disciplinary matters. More than a dozen different laws regulate the gambling industry in the state, but the Casino Control Act 1992 (current as of January 8, 2019) provides the primary legislative framework for the NSW casino sector.

When enacted, the Act declared casino gambling lawful in the state and allowed only one license to be granted and active at any given time. The law, however, also permits a special “restricted gaming facility” in Barangaroo, a small inner-city suburb of Sydney. The casino is currently under construction and is intended as a VIP-only gambling establishment where low-limit gambling and poker machines will not be available. According to Part 2, Section 6 of the Casino Control Act 1992:

“A restricted gaming licence may be granted under this Act to operate the Barangaroo restricted gaming facility. Only one restricted gaming licence may be in force under this Act at any one time.”

Once again, the Independent Liquor & Gaming Authority (ILGA) issues licenses not only to casino operators but to employees as well. Casinos must ensure they prevent underage gambling and any form of criminal activity, including money laundering. Entry to casinos must be controlled, security cameras should cover the entire gaming floor and entrances, and persons under 18 should not be allowed inside.

Northern Territory

Just like elsewhere in Australia, casino gambling in the Northern Territory is fully regulated by the local government. There are currently two land-based casinos, and their licenses are exclusive; no additional operating licenses may be granted without the consent of the existing casino operator. Licensing NT, an agency within the NT Government based in Darwin, issues these licenses. Another authority with regulatory powers is the NT Racing Commission. Both bodies operate under the Department of the Attorney-General and Justice.

The principal legislation governing casinos and their operations in the Northern Territory is the Gaming Control Act 1993. Under Section 34 of the Act, individuals under 18 are not permitted to enter casino premises or play any game of chance. Casinos may offer approved gaming machines and table games to their patrons.

Interestingly, the Gaming Control Act 1993 also contains provisions for online gambling, including online casinos. Part 4, Division 5 of the law defines “Internet gaming” and sets out how this sector is licensed and regulated. According to the Act, the NT Government can issue licenses to internet gaming businesses. However, online gambling operators cannot offer their services to patrons residing in the Northern Territory or anywhere else in Australia. Instead, these online casinos may be based in NT but provide their services offshore.

Queensland

The State of Queensland also permits land-based casino gambling. This sector is fully regulated by the Office of Liquor and Gaming Regulation, an agency within the Department of Justice and Attorney-General. The authority supervises and regulates all gambling activities in Queensland, including machine gaming, casinos, art unions, lotteries, and keno. It also oversees the liquor and adult-industry sectors in the state.

Several casinos operate in Queensland, and their activities are authorized and governed by a wide range of laws and regulations. One of the principal statutes is the Casino Control Act 1982. Many of its provisions have been repealed or amended over the years, with dozens of changes made to the original text. The latest version, from May 2016, allows the granting of casino licenses and hotel-casino complex licenses. According to Section 31 of the Casino Control Act 1982,

“A casino licence may be granted to a person only if the person is the owner of the freehold, or the lessee from the State, of the land used for the particular hotel-casino complex.”

As in the rest of the states, Queensland requires casino employees to apply for a license. Individuals under 18 are not allowed to work in a casino, play any of the games, or enter casino premises.

South Australia

South Australia permits full-scale casino gambling. The state currently has a single casino in Adelaide, which offers table games and gaming machines. As in the rest of Australia, online casinos are not allowed. The gambling industry in South Australia has undergone a major overhaul and is expected to change further in 2020; however, the reforms are not expected to significantly affect the casino sector.

In December 2019, State Parliament passed multiple changes to the gambling legislation with the intention to “bring all gambling regulation and policy functions under the jurisdiction of the Liquor and Gambling Commissioner within Consumer and Business Services (CBS)”. The reforms focus on the operation of lotteries and, most notably, gaming machines, which will now accept banknotes rather than just coins. Gamblers will be able to play poker machines on Christmas Day and Good Friday. However, the ban on gambling during these holidays remains in hotels, clubs, and the Adelaide Casino.

Additional pieces of legislation have also been passed, including the Gambling Administration Act 2019 and the Statutes Amendment (Gambling Regulation) Act 2019, although they have not yet come into force. The main law that governs casino gambling in the state is the Casino Act 1997, which authorizes the operation of the Adelaide Casino, as explained in Section 2A of the Act:

“The object of this Act is to provide for the licensing, supervision and control of the Adelaide Casino and, in particular, to ensure —

(c) that gambling in the Adelaide Casino is conducted responsibly, fairly and honestly, with due regard to minimising the harm caused by gambling; and

(d) that the interest of the State in the taxation of gambling revenue arising from

the operation of the Adelaide Casino is properly protected.”

Therefore, the Act prohibits access to the casino by minors (individuals under 18) and excluded patrons, and it regulates the taxation of gaming revenues generated by the casino.

Tasmania

Gambling in Tasmania is controlled and regulated by the Tasmanian Liquor and Gaming Commission, an independent body within the Department of Treasury and Finance. The Commission is responsible for gambling licensing, compliance, and the regulation of casinos in the state. It is also committed to promoting responsible gambling; it introduced the Mandatory Code of Practice for licensees as well as the Tasmanian Gambling Exclusion Scheme.

The main piece of legislation governing the operation and supervision of casinos is the Gaming Control Act 1993, which regulates casino gaming, sports betting, lotteries, and gaming machines. The Act authorizes the operation of Tasmania’s two casinos, namely the Wrest Point Hotel Casino and Country Club Tasmania, both operated by the Federal Group. According to Section 13 of the Act,

“A licence to operate a casino may be granted in respect of one casino only, but more than one licence may be held by a casino operator concurrently.”

The rules and regulations described in the Act are standard for Australia. For instance, casino gambling (table games and gaming machines) is not permitted for children or minors. Additionally, the Act defines three types of gambling licenses: a licensed premises gaming license, a special employee’s license, and a technician’s license for those who install, service, maintain, or repair gaming equipment and carry out prescribed duties.

Victoria

Casino gambling in the State of Victoria is supervised by the Victorian Commission for Gambling and Liquor Regulation (VCGLR). This independent statutory authority was established in 2012 under the Victorian Commission for Gambling and Liquor Regulation Act 2011, assuming the responsibilities of several institutions: the Director of Liquor Licensing, the Liquor Licensing Panel, and the Victorian Commission for Gambling Regulation.

The VCGLR regulates all businesses and activities involved in gambling to ensure the integrity of the industry and to minimize harm. The Commission is fully responsible for licensing and compliance in the casino sector, while the regulatory framework is set out in the Casino Control Act 1991. The Casino (Management Agreement) Act 1993, meanwhile, details the agreement between the State of Victoria and Crown Melbourne, the only licensed casino in the state.

In 1993, under Part 2 of the Casino Control Act 1991, the casino license was granted to Crown Melbourne Limited. All conditions and requirements, including the maximum and minimum numbers of gaming tables and electronic gaming machines and the boundaries of the casino, are set out in the license. Under Section 25 of the Act, the VCGLR must conduct a review of the casino operator and its license at intervals not exceeding five years.

Western Australia

Western Australia is home to a single casino gambling venue, Crown Perth. Its regulation is overseen by the Gaming and Wagering Commission, a regulatory body established under the Department of Local Government, Sport, and Cultural Industries. The Commission is responsible for supervising and licensing all gambling businesses in the state, including sports wagering and casino gaming.

It administers the laws relating to casino gaming and wagering, most notably the Casino Control Act 1984, which is:

“An Act to provide for the establishment of a casino in Western Australia, for licensing the operator of the casino and for the control of gaming operations therein and for matters incidental to or connected therewith.”

The Act details the licensing process, requiring an applicant to submit a license application to the Commission, together with supporting information and “an application fee of $5,000 or such other amount as is prescribed”. The application must also be reviewed by the Minister who will:

“if the Minister approves of the application concerned, grant to the applicant the casino gaming licence concerned, subject to the same conditions as those to which that approval is subject, and specify those conditions in that casino gaming licence”

The law also states that individuals under 18 are not allowed on casino premises. Several exceptions exist, detailed in Subsection 4 of Section 27 of the Act, and include minors employed in the non-gaming sector of the casino or those dining while accompanied by their parents. Naturally, children cannot participate in gaming activities.

Gambling has long been a popular pastime in Australia, and recent reports suggest that Australians gamble more than anyone else in the world. Betting on sports and horse races is legal and regulated, as are lotteries, gaming machines, and casinos. Moreover, poker machines, as they are known locally, can be found in pubs, sports clubs, hotels, and even shopping malls, where they are as common as ATMs.

Australia, officially the Commonwealth of Australia, is a federal parliamentary constitutional monarchy, and governmental authority is exercised at three levels, namely federal, state/territory, and local governments. The country comprises six states: New South Wales, Victoria, Queensland, Western Australia, South Australia, and Tasmania, as well as two internal territories that function almost as states.

Winnings generated from gambling are not taxed in Australia mainly because gambling is not considered a profession. Even the so-called “professional gamblers” who play poker for a living do not have to pay taxes. Instead, casino operators are taxed based on the particular products they offer and the state or territory in which they are located. In fact, the tax rate is usually determined during negotiations between the local government and the operator. In addition, license fees and other surcharges must also be paid.

Since online casinos are illegal in Australia, there is no need to license or regulate such operations. Despite the ban, dozens of foreign operators are still offering their services to customers in the country. This situation has prompted more active monitoring of the sector, and the Australian Communications and Media Authority (ACMA) has been mandated to block illegal gambling sites.

Australian Capital Territory

Australian Capital Territory New South Wales

New South Wales Northern Territory

Northern Territory Queensland

Queensland South Australia

South Australia Tasmania

Tasmania Victoria

Victoria Western Australia

Western Australia